Who Really Foots the Bill for Probate Attorney Fees in Texas?

When a loved one passes away in Houston, Fort Worth, or Austin, who pays probate attorney fees becomes a pressing concern for grieving families.

Quick Answer:

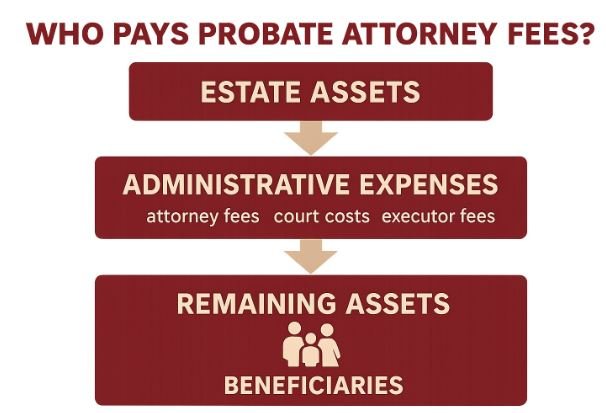

- The estate pays – Attorney fees come from the deceased person’s assets before distribution to beneficiaries.

- Not the executor personally – The person managing the estate isn’t responsible for fees out of their own pocket.

- Beneficiaries are indirectly affected – Fees reduce the total inheritance amount.

- Exceptions exist – In disputes like contested wills, the challenging party may pay their own legal costs.

The probate process can feel overwhelming. As one Texas executor recently shared: “I thought I’d have to pay thousands in legal fees myself, but learning the estate covers these costs was such a relief during an already difficult time.”

In Texas, probate attorney fees typically range from $250 to $400 per hour, with total costs often falling between 3% to 7% of the estate’s value. For a $500,000 estate, you might expect $15,000 to $35,000 in total probate expenses.

The estate acts as a business entity that must settle its debts—including legal fees—before anyone receives their inheritance. This system protects family members from financial burdens while ensuring proper legal representation during the probate process.

The Simple Answer: The Estate Pays for Probate

In Texas, the answer to who pays probate attorney fees is straightforward: the estate pays. When a person passes away, their estate uses its own assets to cover all administrative expenses, including legal fees, court filing costs, and property appraisals. This system ensures that the executor, administrator, or beneficiaries do not have to pay these costs from their own pockets.

This approach protects families in Houston, Fort Worth, and Austin from unexpected financial stress. As one Houston executor told us, “I was worried I’d have to come up with thousands of dollars myself, but when I learned the estate handles these costs, it was like a weight lifted off my shoulders.”

How Probate Fees Impact Beneficiaries

While beneficiaries don’t pay directly, these fees do impact them. Every dollar spent on administrative costs reduces the total value of the estate, which in turn decreases the final inheritance amount distributed. For example, if a $400,000 estate in Austin incurs $25,000 in probate costs, the beneficiaries will share the remaining $375,000. The reduction happens automatically as part of settling the estate—no one receives a separate bill.

This creates a fiduciary duty for the executor or administrator to spend the estate’s money wisely and keep costs reasonable. A skilled probate attorney can often save the estate money by avoiding costly mistakes and resolving issues efficiently, preserving more of the inheritance for beneficiaries.

Deja un comentario