How Texas Probate Lawyers Determine Their Fees

To understand who bears the cost of probate lawyer fees, one must also understand how these charges are figured. Unlike some other states that have prescribed legal fee guidelines, attorney fees for probate in Texas do not have a set percentage. They are instead determined based on what is deemed “reasonable and necessary” for the tasks conducted in cities like Houston, Fort Worth, or Austin.

Several key aspects that affect the overall expenses include the estate's value and complexity, the particular legal services needed (like simple administration compared to contesting probate), the lawyer's level of experience, and the duration needed to finish the probate process. Obviously, handling a substantial and intricate estate will incur higher costs than a simple one.

At our law office, we emphasize openness and make it a priority to thoroughly explain the procedure, assisting families in Houston, Fort Worth, and Austin in understanding the elements that influence their expenses.

Typical Fee Formats in Texas

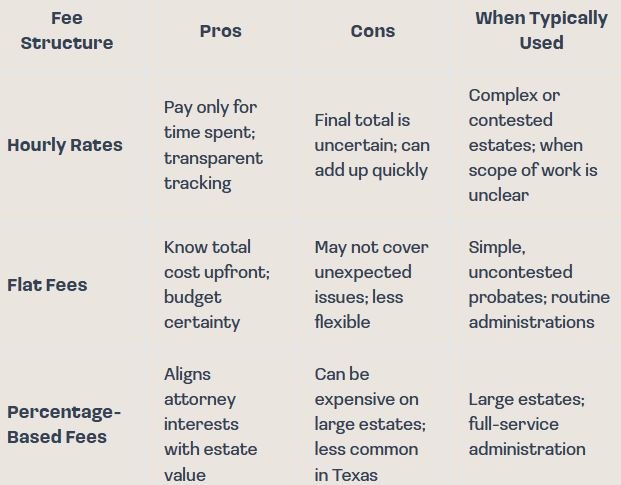

Probate lawyers in Texas generally adopt one of the following fee formats:

Hourly fees in Texas usually fall between $250 and $400. A flat fee for a basic independent administration can range from $3,000 to $8,000. Although not the most common, percentage-based fees can amount to 3% to 7% of the estate's worth. We collaborate with each family to figure out the most suitable fee arrangement for their needs.

The Court’s Function in Fee Validation

In Texas, the probate court guarantees that all attorney charges are “reasonable and necessary.” In a dependent administration, where court supervision is more rigorous, the judge must authorize all fees before they are paid. This adds an extra layer of security for the estate.

In cases of independent administration, which is usually more prevalent and efficient, the executor can pay attorney fees without getting prior approval from the court. However, beneficiaries still retain the right to contest these fees in court if they believe they are excessive. If the court agrees, it has the authority to mandate reimbursement to the estate.

According to the Texas Real Estate Code Fee Classifications, attorney fees are categorized as a high-priority “Class 2” claim, settled after funeral costs but before most other unsecured liabilities. This highlights the significance of legal support in effectively managing an estate.

Deja un comentario